By this time in late-March I would normally be advertising a Seasonal Averaging Program for pricing corn and soybeans. This year, however, I’m choosing to wait a bit longer before starting the averaging program. I realize I’m defying the long-term averages a bit at my own risk of being wrong, but I’ve been wrong before, so at least it will be familiar territory.

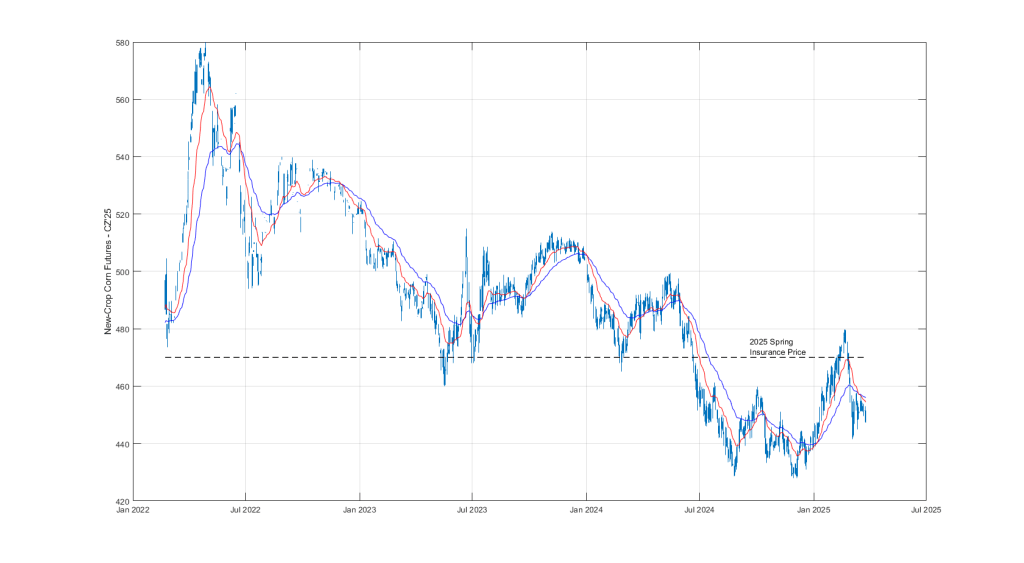

If the corn market hadn’t dropped 10% since February 20th, but instead continued the uptrend it had been in for several months, I would be eager to kick off a new-crop averaging program. However, the new-crop DEC’25 corn futures contract settled today at $4.445 per bushel, 25 cents below the Spring Crop Insurance Price of $4.70. It’s been more than 40 years since the new-crop futures contract has failed to at least recover the February average price. Given the fact that we are at an old-crop stocks/use ratio of 10% on corn, the drought monitor is looking spicy, much of Brazil is drier than normal, and we have the entire North American growing season in front of us, I’m unwilling to sell more of my new-crop production below the insurance guarantee price, or at least not this early in the crop cycle. I feel the same way for soybeans.

Last year we started our corn averaging pool on April 22nd. Given what we know today, I don’t expect to start price averaging any earlier, and may instead begin price averaging much later. I prefer to wait until the DEC’25 contract has breached $4.70 to begin averaging. If that doesn’t happen by June 10th, I will reassess based on weather conditions and market realities at that time.

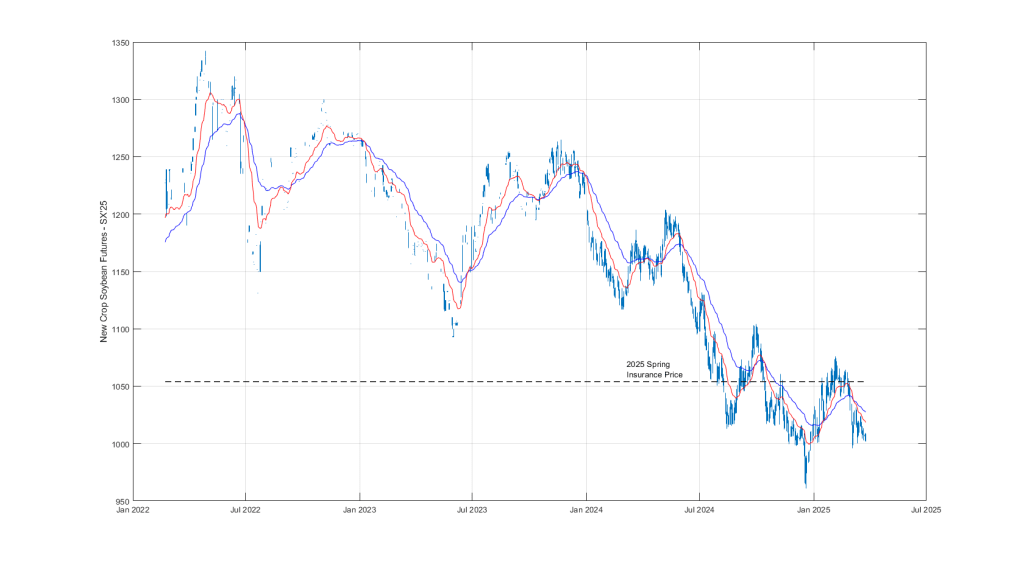

In the case of soybeans, I didn’t run an averaging program last year, and that turned out to be a mistake. Similar to corn, however, November soybean futures are currently below the spring crop insurance price of $10.54, and new-crop cash prices are waaaaaay below breakeven. At the risk of repeating last year’s mistakes, I am not interested in pricing new-crop soybeans today, and my current idea for a first target to get started, $11.50, seems completely out of reach today. As with corn, I will reassess if nothing has been done by June 10th.

I understand that some other grain buyers are pushing ahead with their averaging programs already. It’s too early to know if their market timing will yield better prices, but it’s certainly an advantage for them to get bushels secured early for their program. As a reminder, if you really want to get started now, or if you want to use the averaging dates advertised by some other company, I am always willing to do a custom averaging program for any customer with at least 1,000 bushels to be priced. I can build an averaging program with any reasonable combination of future starting and stopping dates. Option floor protection can be built into the averaging contract for an additional fee.

If you would like me to put you on our “will call” list to contact if/when we start an averaging pool this year, please call your local Cogdill Farm Supply location and let your usual grain buyer know you want to be on the averaging contract call list.