On Monday, March 31st, USDA-NASS will release their Planting Intensions & March 1st Grain Stocks report at 11:00 central time. The average analyst expectation is for 94.4m acres; nearly 4m more acres of corn vs last year, but the estimates range up to 97m acres. In the case of soybeans, the “experts” are guessing we’ll see a decrease of 3.3m acres to 83.8m. The relative profitability of corn vs beans and crop insurance guarantees are strongly incentivizing corn production while discouraging soybean production, which is why many folks are speculating that we’ll see an even greater shift toward corn, and away from soybeans.

So, are these estimates bearish corn and bullish soybean prices? Not necessarily. Even if you knew what NASS was going to report, there’s no way to know in advance how that aligns with market expectations. To make things even more unpredictable, the range of quarterly grain stocks estimates are reportedly much tighter than normal, which increases the odds of a surprise twist to the story. Maybe NASS will print huge corn acreage intentions, which is bearish, but offset by a surprise cut in inventories? Who knows… We’ll all be smarter at 11:01.

The inability to handicap these quarterly NASS reports is why I like to have my grain marketing positioned to withstand either a bullish or bearish outcome. If you will need to sell grain to raise cash in the next 45-60 days, or if you are very concerned about the prospect of new-crop prices going much lower, you should strongly consider taking some action before the report. In the case of old-crop sales, consider selling at least half of what you’ll need to have priced for cash before the end of May.

In the case of new-crop sales, since we’re well below the crop insurance guarantee, I’d be more inclined to either just set some upside price target orders and let them work, or I’d use a Minimum Price Contract. From a mathematical standpoint, a minimum price contract is essentially the same thing as buying a put option: in exchange for paying a premium, you can establish a floor price to prevent further price erosion over a defined window of time, while leaving the upside wide open in case the market rallies. Currently, you can buy about 55 days of “at the market” price protection for 15-20 cents per bushel. An added benefit of minimum price contracts is the ability to cancel the contract with no additional fees in the event you come up short on bushels. Give me a call if you want to know more about minimum price contracts.

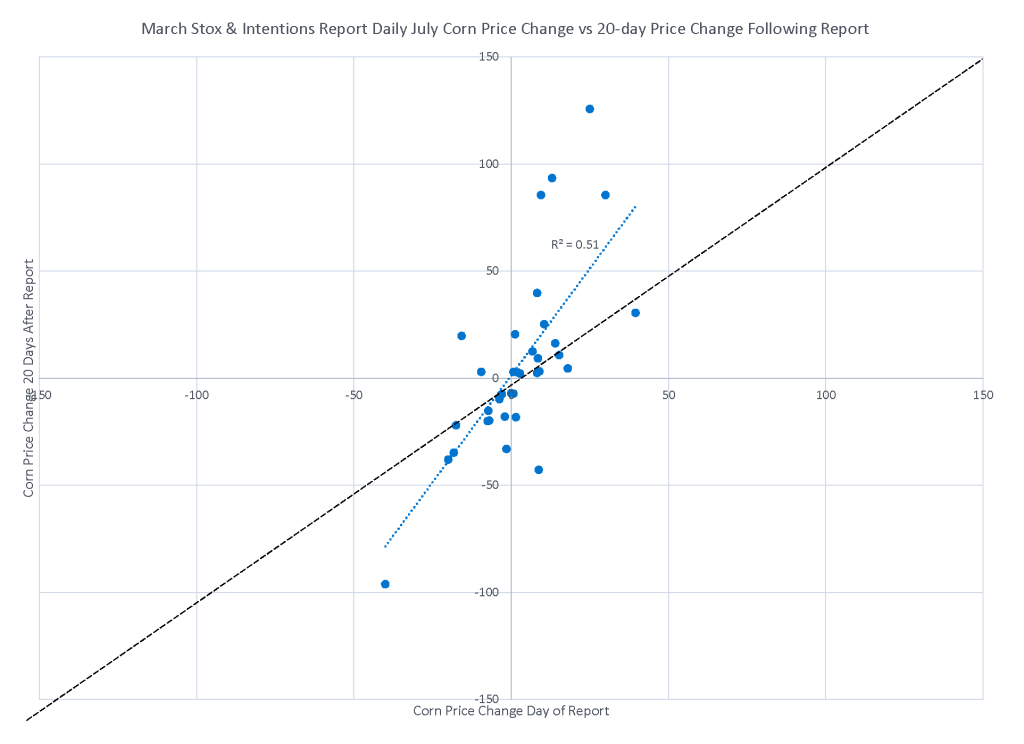

Looking back through history, despite this report’s reputation as a ball buster, it has more often been a turning point toward higher prices, rather than a crash and burn. Out of the past 35 years, the July corn contract has closed lower on the March NASS report only 13 times, for an average drop of 12 cents, and has only closed more than a dime lower on the day 5 times, for an average drop of 22 cents. While there has been absolutely no correlation between price action before and after the report, whatever happens on report day tends to continue. As shown in the plot (below), if the market falls at least a little on report day, it usually drifts even lower over the next 20 days or more. In those 13 years the corn market closed lower on report day, between March 31st and June 30th is 40 cents lower. In other words, a lower close on Monday will be a bad omen for the next 90 days.